It’s time for Second Quarter Estimated Taxes

I know, no one wants to think about taxes – now or ever. I get it. We don’t like them either. But here is something we do. By not sticking your head in the sand and actually being proactive about your taxes will you will save money, stress, headaches, and a slew of other ailments.

I remember when I first learned of “Quarterly Estimated Taxes”. It sounded like a punishment. Why do I have to give chunks of my hard-earned money to the government every quarter? Seemed so unfair.

But… once I understood the reasoning behind it, I sort of got it. And then once I learned what happens when you DON’T make these quarterly estimated payments, I definitely got it. And THEN, when I finally realized how it was actually beneficial to me (not just the government) to make these payments, I never looked back.

So, here’s the thing… if you are an employee, someone who receives a paycheck with your taxes already taken out of that check, then you don’t have to make these estimated payments. Your taxes have been paid in accordance with the amount of money you are paid and the dependents you claim and basically how you filled out your W4. So, you’re good!

However, if you own a business and take “draws”, “distributions”, have profit or pretty much write yourself a check out of your business account, then you need to be making these quarterly estimated payments. Let me rephrase – you WANT to be making these payments.

Here’s how it works…

Step 1: Get your Vouchers

If you are already working with a good CPA, they should provide you with these quarterly vouchers. https://www.irs.gov/pub/irs-pdf/f1040es.pdf for Federal and https://www.mass.gov/doc/2021-form-1-es-estimated-income-tax-payment-voucher-instructions-and-worksheets/download for Massachusetts. You can look up your state’s voucher by doing a simple Google search for “Iowa estimated income tax voucher”. The vouchers that your CPA gives you will already contain your info as well as the amount you should be paying in each quarter. These amounts are determined by your prior year’s tax return.

You see, the way the IRS sees it, if you had a tax liability of $8000 last year, they’re going to assume that you will have about the same tax liability this year. Apparently, the IRS isn’t a true believer in growth. Therefore, when you filed your taxes for the previous year, the fancy-schmancy tax software that your CPA uses will spit out these vouchers with $2000 per quarter on them. This is to make up the $8000 for the year.

What This Means for You

NOW, if you are really kicking butt this year and let’s say you’re doing double what you did last year, that would be double in draws/distributions/profit or some combination thereof. You may want to adjust the quarterly amounts you pay and pay more. Why, you ask? Because if you do not, it may come time to complete your taxes for the year, and the estimated payments you made weren’t enough to cover it. Then you may be whacked with a big tax bill at year-end and get a penalty for not paying enough in through-out the year.

The name of the game in taxes is to net zero at year-end. It’s not to get a big refund (that means the government gets to use your money for free all year). It’s not to owe a large sum either. Not only does that hurt but the IRS doesn’t like that either so you may end up on their radar, and no one wants that.

Step 2: If Not Using Vouchers

You may NOT be working with a good CPA, meaning whomever you are using to file your taxes is not providing you with these vouchers, or (God help you). You may doing the taxes yourself. Then there is another way to get these done. It’s not as good or as exact as having pre-filled vouchers from your CPA. It is still definitely better than doing nothing. Your books need to be done – correctly – at least through May, or a 3-month period of time. Or, you should have a very good idea of what your profitability, in a dollar amount, maybe for that quarter.

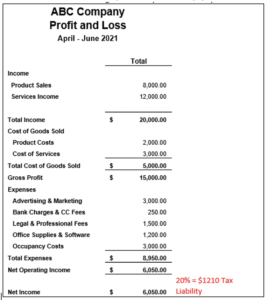

In the graphic below of a quarterly profit & loss, the net income is the profit and this amount is taxable to the Owner(s). An easy way to get an “estimated” amount would be to take 20% of this Net Income and pay that to the IRS. Then whatever your state Income tax is, so for Massachusetts it’s about 5%, and use that calculation for your state’s estimated payment.

Why You Need to Do Quarterly Estimated Taxes

Ok, so now you may be asking, “Why?” Why should I? Well, because you’re going to pay it one way or the other. And wouldn’t you prefer to pay the least amount of taxes, have better cash flow, and not dread April 15th for the rest of your life? Getting behind on your taxes and/or tax payments is like a snowball rolling downhill – and not in a good way. I have been on both sides of it and it is way, way better to know and understand what your tax liability is. And to know and understand why the government taxes and how, and then be super prepared and organized in how you pay it.

Our Reasons:

A) If you ignore or don’t pay your estimated quarterlies, you are subject to fines, interest and then a very large year-end tax payment.

B) They are extremely easy to make as you can (and should) complete them online through the IRS.GOV website and your state website. Plus, you can also set them up for future payments over the year. What’s better than a set it and forget it?

C) Don’t have the money? Well – that’s an entirely different problem that you need to solve ASAP. Ever hear of Profit First? https://sparkbusinessconsulting.com/profit-first/